Those of you in the restaurant industry know better than anyone that the unemployment rate in Australia is at an all time low (3.5%). In a quest to combat the labour shortage issue, the Australian government announced some immediate initiatives including allowing older Australians to work more hours, relaxing work restrictions for international students and increasing the annual immigration intake. The Fair Work Commission also announced earlier this year an increase of 5.2% for the national minimum wage and 4.6% for award minimums.

That means as of July 2022, the minimum wage in Australia has been increased to $21.38 per hour, or $812.44 per 38-hour week. At the same time, minimum award wages above $869.60 per week received a 4.6% increase, while those below $869.60 per week were given a $40 increase.

The decision received mixed response from businesses across the hospitality industry. With skyrocketing inflation and raw food price increases in the mix, this doesn’t come easy to restaurant operators like you.

What does the change in minimum wage policy mean for those of you in the restaurant industry?

In this blog, you’ll learn about:

- Minimum wage and modern awards in Australia

- Who sets the minimum wage in Australia?

- Does the national minimum wage apply for all employees?

- What if I underpaid my employee?

- What is the current superannuation rate for hospitality workers?

- What about allowances and overtime pay?

- How to handle the effects of raising the minimum wage in the restaurant industry

Minimum wage and modern awards in Australia

A minimum wage, according to the International Labour Organisation (ILO) is the minimum amount of remuneration that an employer is required to pay workers for the work performed during a given period. This amount should not be reduced in any circumstances, even with a collective agreement or an individual contract.

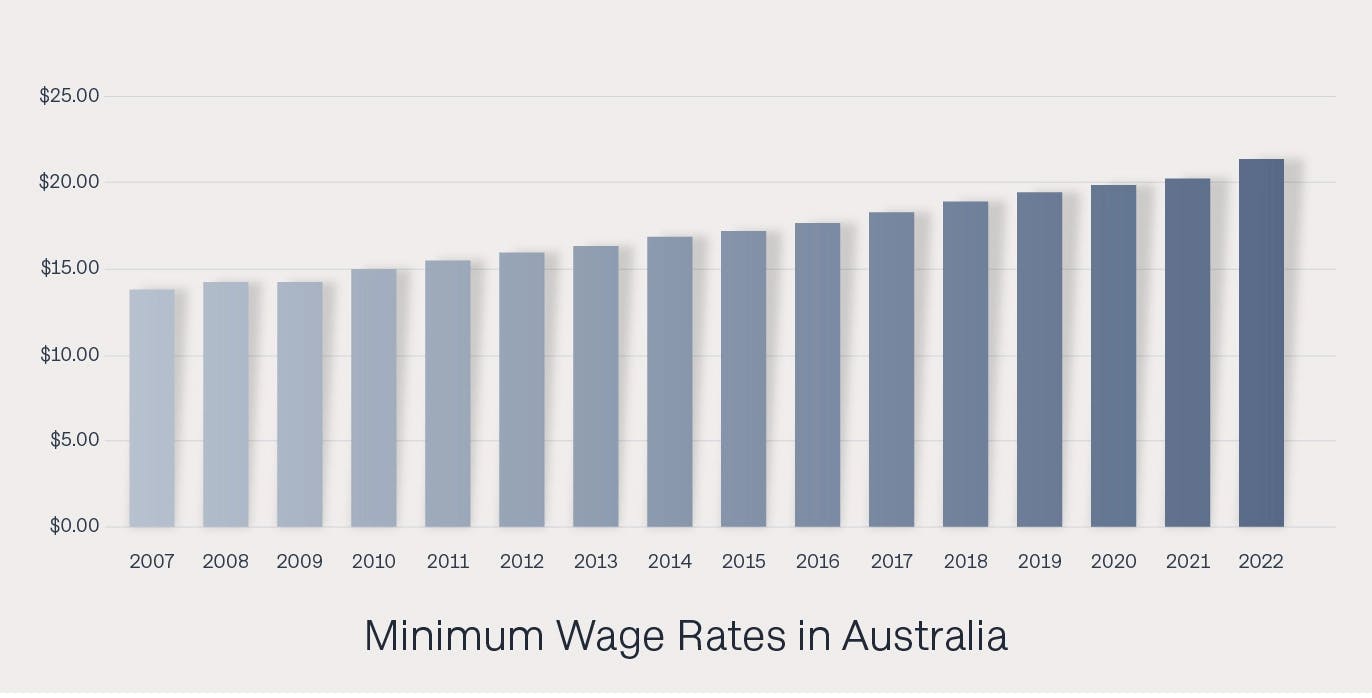

At $21.38 per hour, Australia maintains the world record as the country with the highest minimum wage. With some 2.7 million workers covered by the minimum employment standards benefiting from this decision, let us have a look at how the national minimum wage changed since 2007.

Modern Awards

Most Australians work under an Award system that provides entitlements such as pay, work hours, work shifts, breaks, allowances, penalty rates and overtime. A modern award is mostly determined by an employee’s industry, age, and location, setting out the minimum terms and conditions of the employment on top of the National Employment Standards (NES). The modern awards came into effect in Australia on 1 January 2010 and are applied to all employees covered by the national workplace relations system.

There are a few awards that are applicable to the hospitality industry such as the Fast Food Industry Award and the General Hospitality Industry Award. Learn more about which ones you should be following here.

Who sets the minimum wage in Australia?

The nation’s minimum wage has been set by the Fair Work Commission’s Expert Panel since 2010. The annual wage review usually takes place from March to June, with the decision coming into effect on 1 July of the following financial year.

According to the Fair Work Act 2009, the Panel must make sure that all interested organisations and individuals are given the opportunity to make written submissions and comment on other written submissions. The Expert Panel is then required to make comments on these submissions and make sure that they are published for transparency. As part of the review, the Panel may investigate and report on certain matters which will also be published for the public to view.

Does the national minimum wage apply for all employees?

The national minimum wage applies to all workers who are not covered by a modern award or a registered agreement. On the other hand, employees working under an award system or registered agreement are entitled to the minimum pay rates, including penalty rates and allowances in their award or agreement. However, a different wage system is applied to employees under these circumstances:

1. Junior workers

In Australia, junior workers are defined as young workers under the age of 21. Junior employees are usually paid a percentage of the national minimum wage based on their age and the industry they work in. The percentages that apply are usually based on the employee’s age and should increase on their next birthday.

It’s common to hire junior staff in the restaurant industry. It allows you to save some cost while also keeping your roster filled with part-time help. But it’s worth noting that juniors under the Hospitality and Restaurant Award who sell or serve alcohol are entitled to be paid adult rates regardless of their age. If you don’t serve booze, junior employees are paid at the following percentage according to their age:

2. Workers on the Supported Wage System

The Supported Wage System is applied to employees with disabilities who are not able to perform jobs at the same capacity as other workers. Employers who hire workers under the Supported Wage System pay wages based on the employee’s workplace productivity. The employer along with the employee will be assessed by a certified assessor who will recommend the wages paid to the employee with a disability based on their productivity.

3. Apprentices and Trainees

According to the Fair Work Commission, traineeships and apprenticeships are arrangements that combine formally recognised training with a registered training organisation such as the government-run Technical and Further Education system (TAFE) or trade school, with practical job training work experiences.

From chef apprenticeship to training programmes for front of house staff, this is a great way to mould new employees while ensuring you’re paying fair wage in comparison to level of experience. Here are the latest pay rates for this category.

What happens if I underpay my employee?

Remember that employees cannot be paid less than their applicable minimum wage and entitlements, even if they agree to it. If you realise that you’ve been underpaying your employee due to a mistake or a payroll error, fix the underpayment as soon as possible!

Here are the steps to fix an underpayment:

Step 1: Check your pay records to find out how long the employee was underpaid

Step 2: Work out how much the employee was paid and what they were entitled to be paid

Step 3: Calculate the underpayment amount

Step 4: Communicate with the employee to confirm back payment arrangements

Step 5: Keep up-to-date with future wage increases. You can always subscribe to the Fair Work Commission email updates to receive alerts on the latest minimum wage increases and award changes.

Still unsure about how much you should be paying your workers? Use the Fair Work Pay Calculator tool to work out your employees’ pay rates and other entitlements based on their applicable award.

What is the current superannuation rate in Australia?

Whether your employee is hired as a full-timer, part-timer or as a casual worker, you’re obligated to pay 10.5% of an employee’s ordinary time earnings as superannuation contributions. This is applicable to all employees, including temporary residents who are over 18 years of age or are working 30 hours a week for those who are under 18.

Employers are required to pay for their employees’ supers at least every 3 months into the employee's nominated account. There may also be extra terms regarding superannuation for certain awards, enterprise agreements and other registered agreements. Find out if they are applicable to your business here.

What about allowances, penalty rates and overtime payment?

We know that in the all-consuming food biz, your staff is working extra hours all the time. This means they may also be entitled to allowances, overtime payments or penalty rates.

Allowances

Allowances are extra payments made to employees who work on certain tasks, have a particular skill or tool they use at work, are subject to unpleasant or hazardous conditions or incur an expense for doing their job.

Some common allowances include:

- uniforms and special clothing

- tools and equipment

- travel and fares

- car and phone

- first-aid

- leading hand or supervisor

- Working away from usual workplace

Penalty rates and overtime payment

Penalty rates are higher pay rates for employees who are required to work weekends, public holidays, overtime and late night or early morning shifts.

Let’s look at an example; if you have a full-time restaurant staff working on a public holiday, you’ll pay an estimated penalty rate of $48.11 per hour with a minimum of 4 hours’ payment. This varies depending on the type of penalty, the awards your staff is eligible for and other factors like where your business is located.

Your employee is also entitled to overtime payment when they work extra hours outside of their award or agreement. If you’re looking to save cost and can offer more flexible hours, you can also opt to give your staff paid time off in place of overtime payment.

To learn more about allowances, common penalties and overtime rates in your industry, check out the Fair Work Commission pay guides and use the Pay and Condition tool to calculate how much you need to fork out here!

How to handle the effects of the rising minimum wage

For most restaurant businesses, the minimum wage increase puts extra pressure on top of razor thin profit margins. And with government-mandated costs trending upwards, at least through the next couple of years, we want to help you prepare for the effects with these easy ways:

1. Increase prices (reasonably)

If raising prices is the only way to keep your business afloat, you’ll have to do it in the best way possible! Consider giving notice to customers, particularly regulars, a week or two before your new prices come into effect. While customers may not be surprised with the price hike considering the economy, make sure to also go slow with the increase to avoid losing customers.

2. Rethink your business model

As a restaurant owner, you know better than anyone how quickly restaurant trends have shifted in the past few years. It’s key to update how things work around your restaurant.

If you run a traditional table service restaurant, consider switching to hybrid service to speed up table turns and save on labour costs. For example, direct-to-consumer (D2C) ordering solutions like Direct Orders allow customers to place their pick-up, takeaway, delivery or dine-in orders through a single system. This saves your staff time on taking orders and reduces order errors too!

3. Automate your restaurant

Restaurants are turning to tech to automate operations around the restaurant, with 68% of restaurant operators choosing to increase their tech budget for the next two years. Automating certain tasks will help your restaurant tackle the minimum wage hike and reduce labour costs without sacrificing on your customer’s dining experience. In fact, modern restaurants these days are using 3 technology vendors on average to manage their operations.

Otter provides restaurants like yours with a range of online order management solutions from order auto-acceptance, to consolidated delivery data, menu management and more.

4. Expand into a new revenue stream

You’re cutting costs. You’re bootstrapping. What else is missing? More money! Think about how your restaurant can expand into new revenue streams with your existing resources.

Virtual Brands can help your restaurant unlock new revenue streams by using your existing space, staff, and inventory to fulfil more orders in multiple cuisine types under different brand names. This helps your restaurant increase sales while keeping your expenses in check—making your business more profitable.